what amount do the harrisons report for their adjustments to income?

If y'all are a Medicare beneficiary with a loftier almanac income, it may be a shock to realize your Medicare Part B and Medicare Function D premiums are higher than you initially thought they would be. This difference in premium reflects your Income Related Monthly Adjustment Corporeality (IRMAA).

The Social Security Assistants determines if you owe an IRMAA based on the income yous reported on your IRS tax render two years prior. If you lot feel your higher Medicare Part B premium is incorrect, in that location are steps y'all tin can accept to appeal the IRMAA decision.

What is IRMAA?

IRMAA is the Income Related Monthly Aligning Amount added to your Medicare Role B and Medicare Office D premiums. Yous will only need to pay an IRMAA if your annual modified adjusted gross income (MAGI) exceeds a predetermined corporeality.

In 2003, IRMAA was added every bit a provision to the Medicare Modernization Act. The provision was set to help increase the financial stability of Medicare for futurity beneficiaries. Rather than paying the standard premium, those who qualify for IRMAA must pay a college monthly premium based on their income subclass.

Near Medicare enrollees have Social Security automatically deduct their Medicare Part D and Medicare Part B premium from their Social Security cheque before it is deposited into their bank account each month. If you are not receiving income benefits with Social Security, y'all will typically receive a quarterly beak from Medicare. Regardless of how yous pay your Medicare premiums, you will pay your IRMAA in add-on to your premium each calendar month.

Tin can IRMAA Impact My Medicare Part B Premium?

Your income and tax-filing status from two years ago decide your IRMAA eligibility. If your income exceeds a pre-determined amount, IRMAA can bear upon your Medicare Part B premium. Keep in mind, each year the IRMAA amounts change. Thus, qualifying for IRMAA any year does not authorize you for life.

Depending on income, you lot may not take to pay the additional fee each year. Also, if yous take a special situation and believe IRMAA should not apply to you, you tin can request a redetermination or IRMAA appeal.

How to Calculate IRMAA

To calculate your IRMAA, you will need to review your tax returns submitted to the IRS two years prior to the current yr. Your IRMAA is based on the modified adjusted gross income stated on your tax form.

Refer to the 2022 Medicare IRMAA Nautical chart below for an thought of what Medicare costs you should expect in 2022.

| 2020 annual income: Individual | 2020 annual income: Filing Jointly | 2020 almanac income: Filing separately | Medicare Part B Premium 2022 | Medicare Role D Premium 2022 |

|---|---|---|---|---|

| $0 – $91,000 | $0 – $182,000 | $0 – $91,000 | $170.x | Plan Premium |

| $91,001 – $114,000 | $182,001 – $228,000 | – | $238.10 | Plan Premium + $12.40 |

| $114,001 – $170,000 | $228,001 – $284,000 | – | $340.20 | Programme Premium + $34.10 |

| $142,001 – $170,000 | $284,001 – $240,000 | – | $224.xxx | Programme Premium + $51.lxx |

| $170,001 – $500,000 | $340,001 – $750,000 | $91,001- $409,000 | $544.thirty | Programme Premium + $71.xxx |

| > $500,001 + | $750,001 + | $409,001 + | $587.thirty | Plan Premium + $77.90 |

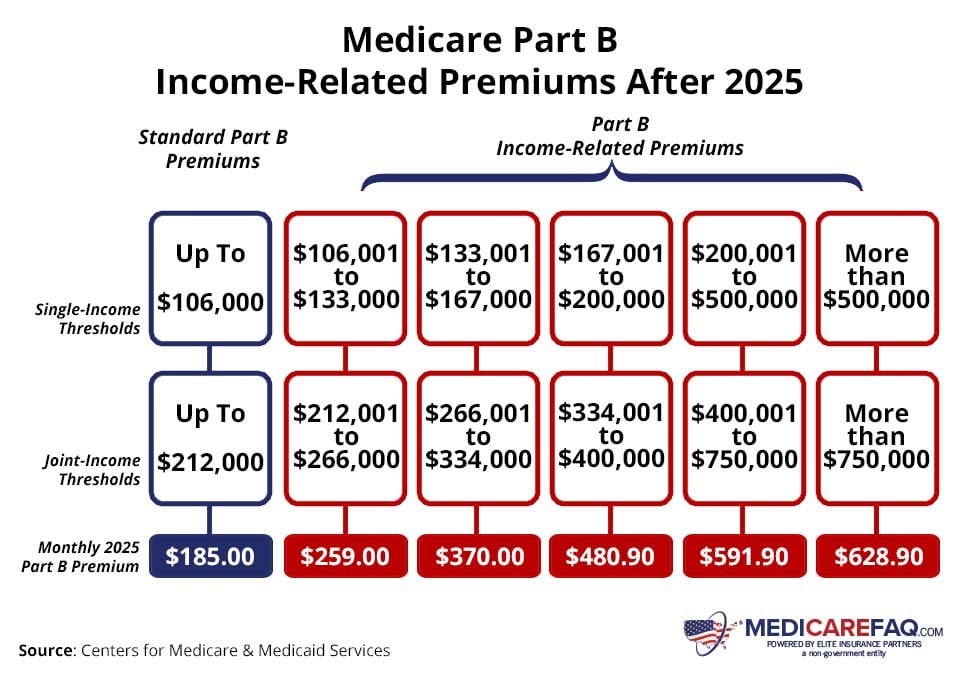

You tin can also view the image beneath for more than details on Medicare Part B income-related premiums after 2022.

What Line is MAGI on 1040?

Your modified adapted gross income corporeality (MAGI) is fabricated up of your total adjusted gross income plus whatsoever taxation-deducted income. If you are unsure of your MAGI, you can quickly effigy information technology out by looking at your taxation return records. On your IRS Form 1040, these are line items 37 and 8b.

If the SSA determines that you owe a college Medicare Role B premium based on your MAGI, they will notify you of your new amount by postal service. All the same, if yous recall the income information Social Security used to determine your Income Related Monthly Aligning Corporeality was wrong or outdated, you can request an appeal for Medicare to revisit the conclusion.

In this example, y'all may need to contact the IRS and correct any incorrect information before y'all file the appeal. Fixing the effect may be as simple as filing an amended taxation return.

A new initial decision is a revised decision that the SSA makes regarding your Income Related Monthly Adjustment Amount. If you have experienced a life-changing issue that caused a decrease in income, you lot can request that the SSA revisit its decision.

Situations Social Security Considers Life-Changing Events:

- Marriage

- Divorce

- Spousal expiry

- You or your spouse cease working or reduce the number of working hours

- Involuntary loss of income-producing belongings due to a natural disaster, affliction, fraud, or other circumstances

- Receipt of the settlement payment from a current or onetime employer due to the employer'southward closure or defalcation

You tin request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. Yous tin can also schedule an appointment with Social Security. Documentation volition be required with proof of the life-changing event that caused your income to go down.

How to Appeal the IRMAA Conclusion

If requesting a new initial conclusion is not an choice, you lot take the right to file an appeal for your Medicare Part B premium increase.

Social Security does not accept a strict timeframe in which they must answer to a afterthought request. If you have questions virtually your appeal status, it is best to contact the bureau currently reviewing your appeal.

An appeal volition non cost you annihilation, and if you state your case well enough, y'all may save yourself some coin.

If you lot want to appeal your IRMAA, you should visit the Social Security website and complete the Request for Reconsideration grade. The form will give you 3 options on how to entreatment, with the easiest and near mutual manner beingness a case review.

Documentation is essential for an appeal. You lot should write a cover letter explaining why you lot believe yous are being overcharged and provide backup documentation.

You tin can appeal your Medicare Part B premium increase for outdated or incorrect information when yous:

- Filed an amended revenue enhancement render with the IRS

- Have a more recent tax render that shows you lot are receiving a lower income than previously reported

For example, let's say y'all were unmarried with an income of $95,000 the year yous retired. Then, two years later, your income is only $45,000 from Social Security and IRA distributions. If this is the case, and then you should not have to pay a college Medicare Part B premium based on your old income.

Documentation Needed to File an IRMAA Appeal

- A alphabetic character from your former employer confirming your retirement

- A copy of your last pay stub to bear witness your decreased income

- Whatsoever official documents that support your case

If you have a successful appeal, Social Security will automatically right your Medicare Role B premium corporeality. If you're denied, they will provide instructions on how to entreatment the denial to an Authoritative Law Judge. While you are in the process of the appeal, y'all will keep to pay the higher Medicare Part B premium.

FAQs

- Was this article helpful ?

- Yep (8)No

How to Get Help With Medicare IRMAA

If you need help understanding your Medicare options, we're here to assist. Requite united states a call today or consummate our online charge per unit form to run into rates in your area now.

Enter your zip code to pull plan options available in your area.

Select which Medicare plans you would like to compare in your expanse.

Compare rates adjacent with plans & carriers available in your area.

Source: https://www.medicarefaq.com/faqs/irmaa/

0 Response to "what amount do the harrisons report for their adjustments to income?"

Post a Comment